Autocallable Notes

Autocallable notes are path-dependent structured products, which may be linked to any index. However, this product is usually linked to equity index or equity basket. If condition called autocall barrier will be reached on any coupon date, the product will be terminated immediately, after paying back coupon (usually fixed) and notional amount. However, if the underlying index will not reach autocall barrier on a coupon date, but reaches condition called coupon barrier, only fixed coupon will be paid on notional and the product will be kept alive until maturity (or until the next autocall event). Autocallables may also have a memory, which means that if the underlying index was below coupon barrier in the previous coupon date (and there was no coupon payment), but will be above coupon barrier in the next coupon date, the product will pay all cumulated (and unpaid) coupons on notional in the next coupon date. Autocallable products are (usually) not capital protected, which means that the investor is not guaranteed to receive the initial investment. If the index fixing on a final coupon date will be below condition called protection barrier, the final redemption amount will be calculated according to specific formula and investor will lose some of the invested capital. There is an example brochure and term sheet available for this product in my GitHub page.

Library Imports

import QuantLib as ql import numpy as np import scipy.optimize as opt

Heston Path Generator

Below is a simple (hard-coded) method for generating paths by using Heston process for a given set of QuantLib dates, which can be unevenly distributed. A couple of notes about Heston path generation process in general. QuantLib MultiPathGenerator has to be used for simulating paths for this specific process, because "under the hood", QuantLib simulates two correlated random variates: one for the asset and another for the volatility. As a result for "one simulation round", MultiPath object will be received from generator. This MultiPath object contains generated paths for the both asset and volatility (multiPath[0] = asset path, multiPath[1] = volatility path). So, for any further purposes (say, to use simulated asset path for something), one can just use generated asset path and ignore volatility path. However, volatility path is available, if there will be some specific purpose for obtaining the information on how volatility has been evolving over time.

# hard-coded generator for Heston process def HestonPathGenerator(dates, dayCounter, process, nPaths): t = np.array([dayCounter.yearFraction(dates[0], d) for d in dates]) nGridSteps = (t.shape[0] - 1) * 2 sequenceGenerator = ql.UniformRandomSequenceGenerator(nGridSteps, ql.UniformRandomGenerator()) gaussianSequenceGenerator = ql.GaussianRandomSequenceGenerator(sequenceGenerator) pathGenerator = ql.GaussianMultiPathGenerator(process, t, gaussianSequenceGenerator, False) paths = np.zeros(shape = (nPaths, t.shape[0])) for i in range(nPaths): multiPath = pathGenerator.next().value() paths[i,:] = np.array(list(multiPath[0])) # return array dimensions: [number of paths, number of items in t array] return paths

Heston Model Calibration

Below is a simple (hard-coded) method for calibrating Heston model into a given volatility surface. Inside this method, process, model and engine are being created. After this, calibration helpers for Heston model are being created by using given volatility surface data. Finally, calibrated model and process are being returned for any further use. The actual optimization workhorse will be given outside of this method. For this specific example program, SciPy's Differential Evolution solver is being used, in order to guarantee global minimization result.

# hard-coded calibrator for Heston model def HestonModelCalibrator(valuationDate, calendar, spot, curveHandle, dividendHandle, v0, kappa, theta, sigma, rho, expiration_dates, strikes, data, optimizer, bounds): # container for heston calibration helpers helpers = [] # create Heston process, model and pricing engine # use given initial parameters for model process = ql.HestonProcess(curveHandle, dividendHandle, ql.QuoteHandle(ql.SimpleQuote(spot)), v0, kappa, theta, sigma, rho) model = ql.HestonModel(process) engine = ql.AnalyticHestonEngine(model) # nested cost function for model optimization def CostFunction(x): parameters = ql.Array(list(x)) model.setParams(parameters) error = [helper.calibrationError() for helper in helpers] return np.sqrt(np.sum(np.abs(error))) # create Heston calibration helpers, set pricing engines for i in range(len(expiration_dates)): for j in range(len(strikes)): expiration = expiration_dates[i] days = expiration - valuationDate period = ql.Period(days, ql.Days) vol = data[i][j] strike = strikes[j] helper = ql.HestonModelHelper(period, calendar, spot, strike, ql.QuoteHandle(ql.SimpleQuote(vol)), curveHandle, dividendHandle) helper.setPricingEngine(engine) helpers.append(helper) # run optimization, return calibrated model and process optimizer(CostFunction, bounds) return process, model

Monte Carlo Valuation

The actual Autocallable valuation algorithm has been implemented in this part of the code. For the sake of being able to value this product also after its inception, valuation method takes past fixings as Python dictionary (key: date, value: fixing). Now, if one changes valuation date to any possible date after inception and before transaction maturity, the product will also be valued accordingly. It should be noted, that in such scheme it is crucial to provide all possible past fixings. Failure to do this, will lead to an exception. Algorithm implementation is a bit long and might look scary, but it is actually really straightforward if one is familiar enough with this specific product.

def AutoCallableNote(valuationDate, couponDates, strike, pastFixings, autoCallBarrier, couponBarrier, protectionBarrier, hasMemory, finalRedemptionFormula, coupon, notional, dayCounter, process, generator, nPaths, curve): # immediate exit trigger for matured transaction if(valuationDate >= couponDates[-1]): return 0.0 # immediate exit trigger for any past autocall event if(valuationDate >= couponDates[0]): if(max(pastFixings.values()) >= (autoCallBarrier * strike)): return 0.0 # create date array for path generator # combine valuation date and all the remaining coupon dates dates = np.hstack((np.array([valuationDate]), couponDates[couponDates > valuationDate])) # generate paths for a given set of dates, exclude the current spot rate paths = generator(dates, dayCounter, process, nPaths)[:,1:] # identify the past coupon dates pastDates = couponDates[couponDates <= valuationDate] # conditionally, merge given past fixings from a given dictionary and generated paths if(pastDates.shape[0] > 0): pastFixingsArray = np.array([pastFixings[pastDate] for pastDate in pastDates]) pastFixingsArray = np.tile(pastFixingsArray, (paths.shape[0], 1)) paths = np.hstack((pastFixingsArray, paths)) # result accumulator global_pv = [] expirationDate = couponDates[-1] hasMemory = int(hasMemory) # loop through all simulated paths for path in paths: payoffPV = 0.0 unpaidCoupons = 0 hasAutoCalled = False # loop through set of coupon dates and index ratios for date, index in zip(couponDates, (path / strike)): # if autocall event has been triggered, immediate exit from this path if(hasAutoCalled): break payoff = 0.0 # payoff calculation at expiration if(date == expirationDate): # index is greater or equal to coupon barrier # pay 100% redemption, plus coupon, plus conditionally all unpaid coupons if(index >= couponBarrier): payoff = notional * (1 + (coupon * (1 + unpaidCoupons * hasMemory))) # index is greater or equal to protection barrier and less than coupon barrier # pay 100% redemption, no coupon if((index >= protectionBarrier) & (index < couponBarrier)): payoff = notional # index is less than protection barrier # pay redemption according to formula, no coupon if(index < protectionBarrier): # note: calculate index value from index ratio index = index * strike payoff = notional * finalRedemptionFormula(index) # payoff calculation before expiration else: # index is greater or equal to autocall barrier # autocall will happen before expiration # pay 100% redemption, plus coupon, plus conditionally all unpaid coupons if(index >= autoCallBarrier): payoff = notional * (1 + (coupon * (1 + unpaidCoupons * hasMemory))) hasAutoCalled = True # index is greater or equal to coupon barrier and less than autocall barrier # autocall will not happen # pay coupon, plus conditionally all unpaid coupons if((index >= couponBarrier) & (index < autoCallBarrier)): payoff = notional * (coupon * (1 + unpaidCoupons * hasMemory)) unpaidCoupons = 0 # index is less than coupon barrier # autocall will not happen # no coupon payment, only accumulate unpaid coupons if(index < couponBarrier): payoff = 0.0 unpaidCoupons += 1 # conditionally, calculate PV for period payoff, add PV to local accumulator if(date > valuationDate): df = curveHandle.discount(date) payoffPV += payoff * df # add path PV to global accumulator global_pv.append(payoffPV) # return PV return np.mean(np.array(global_pv))

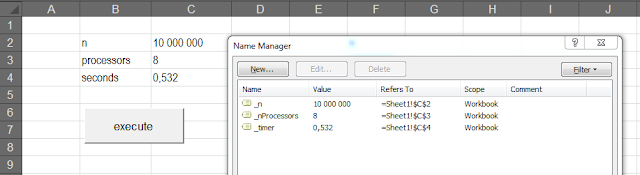

Main Program

Finally, in this part of the program we will actually use the stuff presented above. First, the usual QuantLib-related parameters are being created, as well as parameters for Autocallable product. Note, that since in this example we are valuing this product at inception, there is no need to provide any past fixings for valuation method (however, it is not forbidden either). After this, interest rate curve and dividend curve will be created, as well as volatility surface data for calibration purposes. Next, initial guesses for Heston parameters will be set and the model will then be calibrated by using dedicated method. Finally, calibrated process will be given to the actual valuation method and Monte Carlo valuation will be processed.

# general QuantLib-related parameters valuationDate = ql.Date(20,11,2019) ql.Settings.instance().evaluationDate = valuationDate convention = ql.ModifiedFollowing dayCounter = ql.Actual360() calendar = ql.TARGET() # Autocallable Memory Coupon Note notional = 1000000.0 spot = 3550.0 strike = 3550.0 autoCallBarrier = 1.0 couponBarrier = 0.8 protectionBarrier = 0.6 finalRedemptionFormula = lambda indexAtMaturity: min(1.0, indexAtMaturity / strike) coupon = 0.05 hasMemory = True # coupon schedule for note startDate = ql.Date(20,11,2019) firstCouponDate = calendar.advance(startDate, ql.Period(1, ql.Years)) lastCouponDate = calendar.advance(startDate, ql.Period(7, ql.Years)) couponDates = np.array(list(ql.Schedule(firstCouponDate, lastCouponDate, ql.Period(ql.Annual), calendar, ql.ModifiedFollowing, ql.ModifiedFollowing, ql.DateGeneration.Forward, False))) # create past fixings into dictionary pastFixings = {} #pastFixings = { ql.Date(20,11,2020): 99.0, ql.Date(22,11,2021): 99.0 } # create discounting curve and dividend curve, required for Heston model curveHandle = ql.YieldTermStructureHandle(ql.FlatForward(valuationDate, 0.01, dayCounter)) dividendHandle = ql.YieldTermStructureHandle(ql.FlatForward(valuationDate, 0.0, dayCounter)) # Eurostoxx 50 volatility surface data expiration_dates = [ql.Date(19,6,2020), ql.Date(18,12,2020), ql.Date(18,6,2021), ql.Date(17,12,2021), ql.Date(17,6,2022), ql.Date(16,12,2022), ql.Date(15,12,2023), ql.Date(20,12,2024), ql.Date(19,12,2025), ql.Date(18,12,2026)] strikes = [3075, 3200, 3350, 3550, 3775, 3950, 4050] data = [[0.1753, 0.1631, 0.1493, 0.132 , 0.116 , 0.108 , 0.1052], [0.1683, 0.1583, 0.147 , 0.1334, 0.1212, 0.1145, 0.1117], [0.1673, 0.1597, 0.1517, 0.1428, 0.1346, 0.129 , 0.1262], [0.1659, 0.1601, 0.1541, 0.1474, 0.1417, 0.1381, 0.1363], [0.1678, 0.1634, 0.1588, 0.1537, 0.1493, 0.1467, 0.1455], [0.1678, 0.1644, 0.1609, 0.1572, 0.1541, 0.1522, 0.1513], [0.1694, 0.1666, 0.1638, 0.1608, 0.1584, 0.1569, 0.1562], [0.1701, 0.168 , 0.166 , 0.164 , 0.1623, 0.1614, 0.161 ], [0.1715, 0.1698, 0.1682, 0.1667, 0.1654, 0.1648, 0.1645], [0.1724, 0.171 , 0.1697, 0.1684, 0.1675, 0.1671, 0.1669]] # initial parameters for Heston model theta = 0.01 kappa = 0.01 sigma = 0.01 rho = 0.01 v0 = 0.01 # bounds for model parameters (1=theta, 2=kappa, 3=sigma, 4=rho, 5=v0) bounds = [(0.01, 1.0), (0.01, 10.0), (0.01, 1.0), (-1.0, 1.0), (0.01, 1.0)] # calibrate Heston model, print calibrated parameters calibrationResult = HestonModelCalibrator(valuationDate, calendar, spot, curveHandle, dividendHandle, v0, kappa, theta, sigma, rho, expiration_dates, strikes, data, opt.differential_evolution, bounds) print('calibrated Heston parameters', calibrationResult[1].params()) # monte carlo parameters nPaths = 10000 # request and print PV PV = AutoCallableNote(valuationDate, couponDates, strike, pastFixings, autoCallBarrier, couponBarrier, protectionBarrier, hasMemory, finalRedemptionFormula, coupon, notional, dayCounter, calibrationResult[0], HestonPathGenerator, nPaths, curveHandle) print(PV)

Finally, thanks for reading this blog and have a pleasant wait for the coming Christmas.

-Mike