Third-party analytics softwares will usually require a full set of market data to be feeded into system, before performing any of those precious high intensity calculations. Market data (curves, surfaces, fixing time-series, etc.) has to be feeded into system following some specific file configurations. Moreover, source data might have to be collected from several different vendor sources. Needless to say, the process can easily turn into a semi-manageable mess involving Excel workbooks and a lot of manual processing, which is always a bad omen.

For this reason, I finally ended up creating one possible design solution for flexible processing of market data files. I have been going through some iterations starting with

Abstract Factory, before landing with the current one using

Delegates to pair data and algorithms. With the current solution, I start to feel quite comfortable already.

UML

Each market data point (such as mid USD swap rate for 2 years) is presented as a

RiskFactor object. All individual RiskFactor objects are hosted in a list inside generic

MarketDataElements<T> object, which enables hosting any type of data. MarketDataElements<T> object itself is hosted by static

BaseMarket class.

The actual algorithms needed for creating any type of vendor data are captured in static

ProcessorLibrary class. During the processing task, MarketDataElements<T> object will be handled for a specific library method implementation, which will then request values from vendor source for all involved RiskFactor objects. In the example program, ProcessorLibrary has a method for processing RiskFactor objects using Bloomberg market data API. This specific method is then using DummyBBCOMMWrapper class for requesting values for a RiskFactor object.

For the purpose of pairing specific data (MarketDataElements<T>) and specific algorithm (ProcessorLibrary), BaseMarket class is hosting a list of

ElementProcessor objects as well as a list of

Delegates bound with specific methods found in ProcessorLibrary. For the processing task, each ElementProcessor object is feeded with delegate method for specific ProcessorLibrary implementation method and information on MarketDataElements<T> object.

Finally, (not shown in UML) program is also using static

TextFileHandler class for handling text files and static

Configurations class for hosting hardcoded configurations, initially read from App.config file.

Files

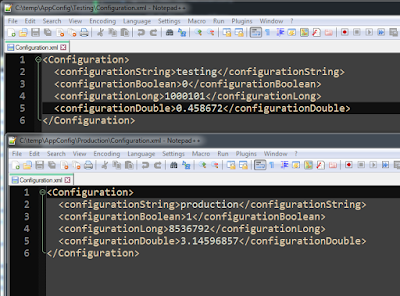

App.config

CSV for all RiskFactor object configurations

Fields (matching with RiskFactor object properties) :

- Data vendor identification string, matching with the one given in configuration file

- Identification code (ticker) for a market data element, found in the system for which the data will be created

- Vendor ticker for a market data element (Bloomberg ISIN code)

- Field name for a market data element (Bloomberg field PX_MID)

- Divider (Bloomberg is presenting a rate as percentage 1.234, but target system may need to have an input as absolute value 0.01234)

- Empty field for a value to be processed by specific processor implementation for specific data vendor.

Result CSV

The program

Create a new console project and CopyPaste the following program into corresponding CS

files. When testing the program in a real production environment, just add reference

to Bloomberg API DLL file and replace DummyBBCOMMWrapper class with

this.

Adding a new data vendor processor XYZ involves the following four easy steps :

- Update providers in App.config file : <add key="RiskFactorDataProviders" value="BLOOMBERG,XYZ" />

- Create a new method implementation into ProcessorLibrary : public static void ProcessXYZRiskFactors(dynamic marketDataElements) { // implement algorithm}

- Add selection for a new processor into BaseMarket class method createElementProcessors: if(dataProviderString.ToUpper() == "XYZ") elementProcessors.Add(new ElementProcessor(ProcessorLibrary.ProcessXYZRiskFactors, elements));

- Create new RiskFactor object configurations into source file for a new vendor XYZ

Finally, thanks for reading my blog.

-Mike

// MainProgram.cs

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

namespace MarketDataProcess

{

class MainProgram

{

static void Main(string[] args)

{

try

{

// process base market risk factors to file

BaseMarket.Process();

BaseMarket.PrintToFile();

}

catch (Exception e)

{

Console.WriteLine(e.Message);

}

}

}

}

//

//

//

//

// BaseMarket.cs

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

namespace MarketDataProcess

{

// class for administrating risk factors and processors for base market

public static class BaseMarket

{

private static List<string> inputFileStreams = new List<string>();

private static MarketDataElements<RiskFactor> riskFactors = new MarketDataElements<RiskFactor>();

private static List<ElementProcessor> elementProcessors = new List<ElementProcessor>();

private static int nRiskFactors = 0;

//

public static void Process()

{

// read all source data string streams from file into list

TextFileHandler.Read(Configurations.BaseMarketSourceDataFilePathName, inputFileStreams);

//

// extract string streams and create risk factor objects

foreach (string inputFileStream in inputFileStreams)

{

RiskFactor element = new RiskFactor();

element.Create(inputFileStream);

riskFactors.AddElement(element);

}

nRiskFactors = riskFactors.elements.Count;

//

// create and execute market data element processors

// finally run technical check on created risk factors

BaseMarket.createElementProcessors();

elementProcessors.ForEach(processor => processor.Process());

BaseMarket.Check();

}

public static void PrintToFile()

{

// write created base market risk factors into file

StringBuilder stream = new StringBuilder();

for (int i = 0; i < riskFactors.elements.Count; i++)

{

stream.AppendLine(String.Format("{0},{1}", riskFactors.elements[i].systemTicker, riskFactors.elements[i].value));

}

TextFileHandler.Write(Configurations.BaseMarketResultDataFilePathName, stream.ToString(), false);

}

private static void createElementProcessors()

{

// market data element processor types are defined in configuration file

List<string> dataProviderStrings = Configurations.RiskFactorDataProviders.Split(',').ToList<string>();

//

foreach (string dataProviderString in dataProviderStrings)

{

if (dataProviderString == String.Empty) throw new Exception("No element processor defined");

List<RiskFactor> elements = riskFactors.elements.Where(factor => factor.provider == dataProviderString).ToList<RiskFactor>();

if(dataProviderString.ToUpper() == "BLOOMBERG") elementProcessors.Add(new ElementProcessor(ProcessorLibrary.ProcessBloombergRiskFactors, elements));

}

}

public static MarketDataElements<RiskFactor> GetRiskFactors()

{

// create and return deep copy of all base market risk factors

return riskFactors.Clone();

}

private static void Check()

{

int nValidRiskFactors = 0;

//

// loop through all created risk factors for base market

for (int i = 0; i < riskFactors.elements.Count; i++)

{

// extract risk factor to be investigated for valid value

RiskFactor factor = riskFactors.elements[i];

//

// valid value inside risk factor should be double-typed converted to string, ex. "0.05328"

// check validity of this value with Double

// TryParse-method returning TRUE if string value can be converted to double

double value = 0;

bool isValid = Double.TryParse(factor.value, out value);

if (isValid) nValidRiskFactors++;

//

// if value is not convertable to double, get user input for this value

if (!isValid)

{

while (true)

{

Console.Write(String.Format("Provide input for {0} >", factor.systemTicker));

bool validUserInput = Double.TryParse(Console.ReadLine(), out value);

if (validUserInput)

{

factor.value = value.ToString();

nValidRiskFactors++;

break;

}

else

{

// client is forced to set (at least technically) valid value

Console.WriteLine("Invalid value, try again");

}

}

}

}

}

}

}

//

//

//

//

// Configurations.cs

using System;

using System.Configuration;

namespace MarketDataProcess

{

// static class for hosting configurations

public static class Configurations

{

// readonly data for public sharing

public static readonly string RiskFactorDataProviders;

public static readonly string BaseMarketSourceDataFilePathName;

public static readonly string BaseMarketResultDataFilePathName;

//

// private constructor will be called just before any configuration is requested

static Configurations()

{

// configuration strings are assigned to static class data members for easy access

RiskFactorDataProviders = ConfigurationManager.AppSettings["RiskFactorDataProviders"].ToString();

BaseMarketSourceDataFilePathName = ConfigurationManager.AppSettings["BaseMarketSourceDataFilePathName"].ToString();

BaseMarketResultDataFilePathName = ConfigurationManager.AppSettings["BaseMarketResultDataFilePathName"].ToString();

}

}

}

//

//

//

//

// MarketDataElement.cs

using System;

using System.Collections.Generic;

using System.Linq;

namespace MarketDataProcess

{

// generic template for all types of market data elements (risk factors, fixings)

public class MarketDataElements<T> where T : ICloneable, new()

{

public List<T> elements = new List<T>();

public void AddElement(T element)

{

elements.Add(element);

}

public MarketDataElements<T> Clone()

{

// create a deep copy of market data elements object

MarketDataElements<T> clone = new MarketDataElements<T>();

//

// copy content for all elements into a list

List<T> elementList = new List<T>();

foreach (T element in elements)

{

elementList.Add((T)element.Clone());

}

clone.elements.AddRange(elementList);

return clone;

}

}

// risk factor as market data element

public class RiskFactor : ICloneable

{

public string provider;

public string systemTicker;

public string vendorTicker;

public string vendorField;

public string divider;

public string value;

//

public RiskFactor() { }

public void Create(string stream)

{

List<string> fields = stream.Split(',').ToList<string>();

this.provider = fields[0];

this.systemTicker = fields[1];

this.vendorTicker = fields[2];

this.vendorField = fields[3];

this.divider = fields[4];

this.value = fields[5];

}

public object Clone()

{

RiskFactor clone = new RiskFactor();

clone.provider = this.provider;

clone.systemTicker = this.systemTicker;

clone.vendorTicker = this.vendorTicker;

clone.vendorField = this.vendorField;

clone.divider = this.divider;

clone.value = this.value;

return clone;

}

}

// fixing as market data element

public class Fixing : ICloneable

{

public string provider;

public string systemTicker;

public string vendorTicker;

public string vendorField;

public string frequency;

public string nYearsBack;

public string divider;

public string value;

public Dictionary<string, string> timeSeries = new Dictionary<string, string>();

//

public Fixing() { }

public void Create(string stream)

{

List<string> fields = stream.Split(',').ToList<string>();

this.provider = fields[0];

this.systemTicker = fields[1];

this.vendorTicker = fields[2];

this.vendorField = fields[3];

this.frequency = fields[4];

this.nYearsBack = fields[5];

this.divider = fields[6];

this.value = fields[7];

}

public object Clone()

{

Fixing clone = new Fixing();

clone.provider = this.provider;

clone.systemTicker = this.systemTicker;

clone.vendorTicker = this.vendorTicker;

clone.vendorField = this.vendorField;

clone.divider = this.divider;

clone.value = this.value;

//

// create deep copy of timeseries dictionary

Dictionary<string, string> timeSeriesClone = new Dictionary<string, string>();

foreach (KeyValuePair<string, string> kvp in this.timeSeries)

{

timeSeriesClone.Add(kvp.Key, kvp.Value);

}

clone.timeSeries = timeSeriesClone;

return clone;

}

}

}

//

//

//

//

// ElementProcessor.cs

using System;

using System.Collections.Generic;

namespace MarketDataProcess

{

// algorithm for creating market data element objects

public delegate void Processor(dynamic marketDataElements);

//

// class for hosting data and algorithm

public class ElementProcessor

{

private Processor taskProcessor;

dynamic marketDataElements;

public ElementProcessor(Processor taskProcessor, dynamic marketDataElements)

{

this.taskProcessor = taskProcessor;

this.marketDataElements = marketDataElements;

}

public void Process()

{

taskProcessor.Invoke(marketDataElements);

}

}

}

//

//

//

//

// ProcessorLibrary.cs

using System;

using System.Collections.Generic;

using System.Linq;

namespace MarketDataProcess

{

public static class ProcessorLibrary

{

public static void ProcessBloombergRiskFactors(dynamic marketDataElements)

{

List<RiskFactor> riskFactors = (List<RiskFactor>)marketDataElements;

BBCOMMWrapper.BBCOMMDataRequest request;

dynamic[, ,] result = null;

string SYSTEM_DOUBLE = "System.Double";

int counter = 0;

//

// group data list into N lists grouped by distinct bloomberg field names

var dataGroups = riskFactors.GroupBy(factor => factor.vendorField);

//

// process each group of distinct bloomberg field names

for (int i = 0; i < dataGroups.Count(); i++)

{

// extract group, create data structures for securities and fields

List<RiskFactor> dataGroup = dataGroups.ElementAt(i).ToList<RiskFactor>();

List<string> securities = new List<string>();

List<string> fields = new List<string>() { dataGroup[0].vendorField };

//

// import securities into data structure feeded to bloomberg api

for (int j = 0; j < dataGroup.Count; j++)

{

securities.Add(dataGroup[j].vendorTicker);

}

//

// create and use request object to retrieve bloomberg data

request = new BBCOMMWrapper.ReferenceDataRequest(securities, fields);

result = request.ProcessData();

//

// write retrieved bloomberg data into risk factor group data

for (int k = 0; k < result.GetLength(0); k++)

{

string stringValue;

dynamic value = result[k, 0, 0];

//

if (value.GetType().ToString() == SYSTEM_DOUBLE)

{

// handle output value with divider only if retrieved value is double

// this means that data retrieval has been succesfull

double divider = Convert.ToDouble(dataGroup[k].divider);

stringValue = (value / divider).ToString();

dataGroup[k].value = stringValue;

counter++;

}

else

{

// write non-double value (bloomberg will retrieve #N/A) if retrieved value is not double

stringValue = value.ToString();

dataGroup[k].value = stringValue;

}

}

}

}

}

}

//

//

//

//

// DummyBBCOMMWrapper.cs

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using System.Threading.Tasks;

namespace BBCOMMWrapper

{

// abstract base class for data request

public abstract class BBCOMMDataRequest

{

// input data structures

protected List<string> securityNames = new List<string>();

protected List<string> fieldNames = new List<string>();

//

// output result data structure

protected dynamic[, ,] result;

//

public dynamic[, ,] ProcessData()

{

// instead of the actual Bloomberg market data, random numbers are going to be generated

Random randomGenerator = new Random(Math.Abs(Guid.NewGuid().GetHashCode()));

//

for (int i = 0; i < securityNames.Count; i++)

{

for (int j = 0; j < fieldNames.Count; j++)

{

result[i, 0, j] = randomGenerator.NextDouble();

}

}

return result;

}

}

//

// concrete class implementation for processing reference data request

public class ReferenceDataRequest : BBCOMMDataRequest

{

public ReferenceDataRequest(List<string> bloombergSecurityNames,

List<string> bloombergFieldNames)

{

securityNames = bloombergSecurityNames;

fieldNames = bloombergFieldNames;

result = new dynamic[securityNames.Count, 1, fieldNames.Count];

}

}

}

//

//

//

//

// TextFileHandler.cs

using System;

using System.Collections.Generic;

using System.IO;

namespace MarketDataProcess

{

public static class TextFileHandler

{

public static void Read(string filePathName, List<string> output)

{

// read file content into list

StreamReader reader = new StreamReader(filePathName);

while (!reader.EndOfStream)

{

output.Add(reader.ReadLine());

}

reader.Close();

}

public static void Write(string filePathName, List<string> input, bool append)

{

// write text stream list to file

StreamWriter writer = new StreamWriter(filePathName, append);

input.ForEach(it => writer.WriteLine(it));

writer.Close();

}

public static void Write(string filePathName, string input, bool append)

{

// write bulk text stream to file

StreamWriter writer = new StreamWriter(filePathName, append);

writer.Write(input);

writer.Close();

}

}

}